Calculate payroll deductions manually

Discover ADP Payroll Benefits Insurance Time Talent HR More. Free Unbiased Reviews Top Picks.

The Cost Of Manual Payroll Human Error Calculator

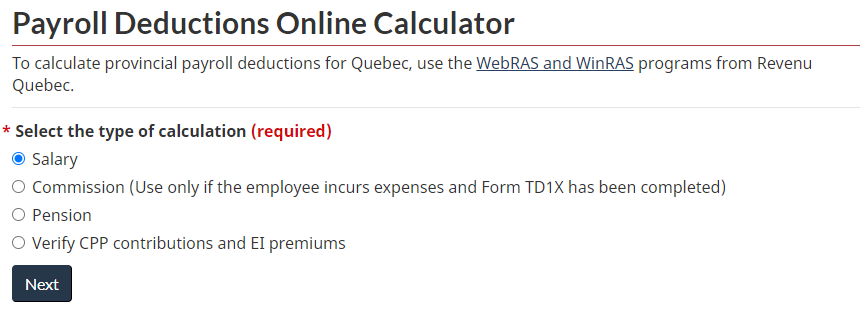

But the CRA has an online calculator tool that can help calculate payroll deductions for you.

. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Ad Choose From the Best Employee Payroll Services Tailored To Your Needs. Use the Free Paycheck Calculators for any gross-to-net calculation need. The maximum an employee will pay in 2022 is 911400.

The first step is the easiest as all that you need to do is multiply the employees hours worked by his or her hourly rate of pay. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an. Before you manually calculate payroll check out our guide to managing payroll to get your business ready to process payroll.

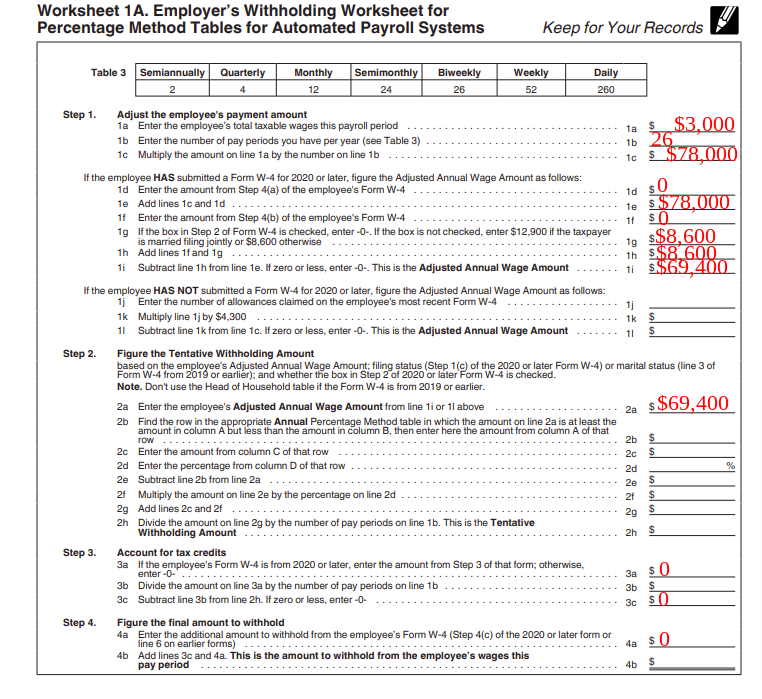

Subtract 12900 for Married otherwise. Ad Prevent Expensive Mistakes With Unlimited Guidance and Support From Uour HR Manager. For more information on the manual calculation.

Total Non-Tax Deductions. Prepare your business to process payroll. Intelligent user-friendly solutions to the never-ending realm of what-if scenarios.

It will confirm the deductions you include on your. Get Started With ADP Payroll. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software. You have to deduct tax according to the claim code that corresponds to the total claim amount the employee has on Form TD1. Ensure Accurate and Compliant Employee Classification for Every Payroll.

Check your payroll calculations manually. All Services Backed by Tax Guarantee. Give Your Business A Boost With Simple Easy Payroll Services.

A full how-to guide on using the payroll deduction calculator can be found. Ad Process Payroll Faster Easier With ADP Payroll. Ad Prevent Expensive Mistakes With Unlimited Guidance and Support From Uour HR Manager.

For example 40 hrs. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Ad Get the Payroll Tools your competitors are already using - Start Now.

Payroll Seamlessly Integrates With QuickBooks Online. Ad Compare This Years Top 5 Free Payroll Software. You can use our Payroll Deductions Online Calculator PDOC to calculate payroll deductions for all provinces and territories except Quebec.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. 2022 Federal income tax withholding calculation. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Heres a step-by-step guide to walk you through. You can enter your current payroll information and deductions and.

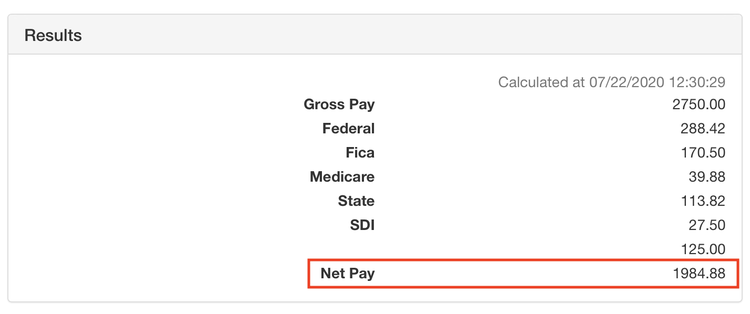

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. To run payroll manually youll need to make several calculations to determine the employees net pay and the companys quarterly reports and taxes see below for. Ensure Accurate and Compliant Employee Classification for Every Payroll.

Use this calculator to help you determine the impact of changing your payroll deductions.

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Do Payroll Yourself In 8 Steps Youtube

How To Choose Right Paystub Generator For Business Administrative Jobs Business Financial Advice

How To Calculate Net Pay Step By Step Example

How To Calculate Payroll Taxes Methods Examples More

Payroll Deductions No Calculating Correctly

How To Calculate Payroll Taxes Methods Examples More

Here Is A Central Hub For All It Teams To Build New Software Or Optimize Your Network System You Can Op In 2022 Data Visualization Data Visualization Tools Flow Chart

How To Calculate Payroll Taxes In 5 Steps

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Zmx3dth5rdxojm

Payroll Report Definition How To Free Sample Templates Hourly Inc

Federal Income Tax Fit Payroll Tax Calculation Youtube

A Small Business Guide To Doing Manual Payroll

How To Enter Payroll Taxes Manually

How To Calculate Payroll Taxes Methods Examples More